CMA’s Salary Survey 2023/24

Given the constantly evolving business and macroeconomic environment, which appears increasingly dynamic, we believe it’s crucial to monitor these shifts in the market and maintain a proactive stance to stay at the forefront.

Every year we benchmark roles across the accountancy, finance and HR sectors to ascertain the remuneration levels and trends. The survey results are collated from over 800 data points across the Solent, Surrey and Thames Valley regions.

We believe sharing this information assists both our clients and candidates in navigating these evolving times, together.

These findings help both employees and employers ensure they are receiving – and paying – a competitive sum. Alongside this, we also do a deep dive into the data and analyse factors affecting all aspects of recruitment in our area.

Data was collected September-October 2023. Download the full Salary Survey.

Key findings

- Business confidence in the short and medium term remains robust in the region despite the on-going macroeconomic challenges.

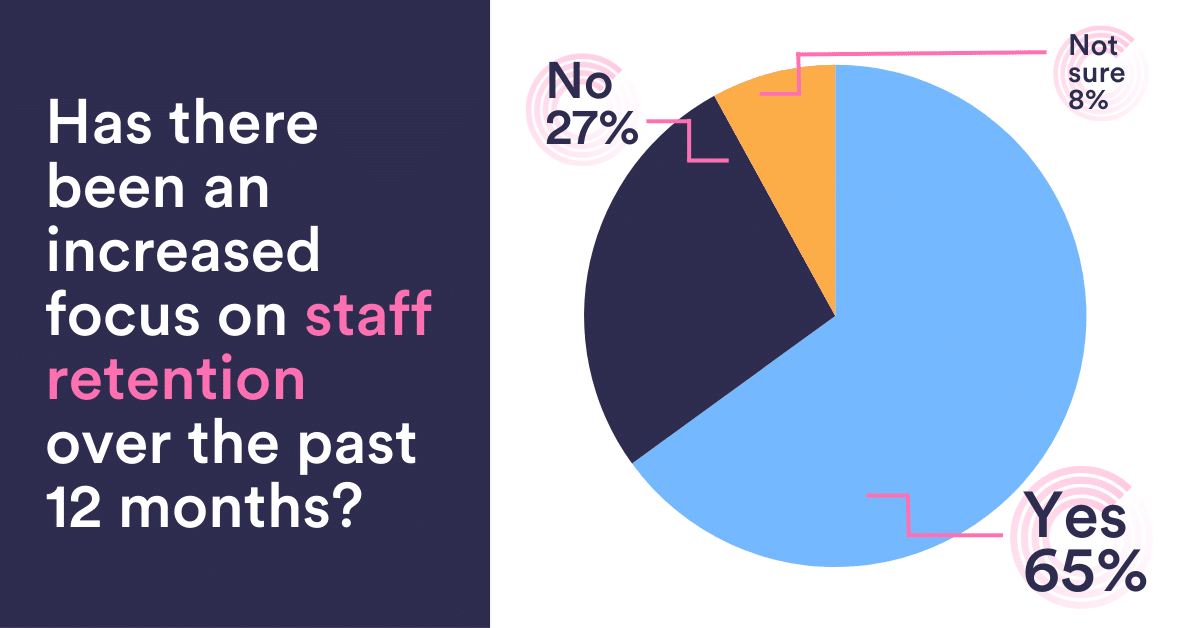

- Nearly two thirds of businesses (65%) have increased their focus on staff retention and staff development over the past 12 months.

- Counter offers have increased significantly in 2023 with 42% of businesses extending more over this period.

- 59% of businesses in the region intend to recruit in the next 3-6 months, with the vast majority of this being permanent headcount.

- Better pay and improved culture are the main two factors that are acknowledged by businesses as the key criteria to influence staff to stay in their company.

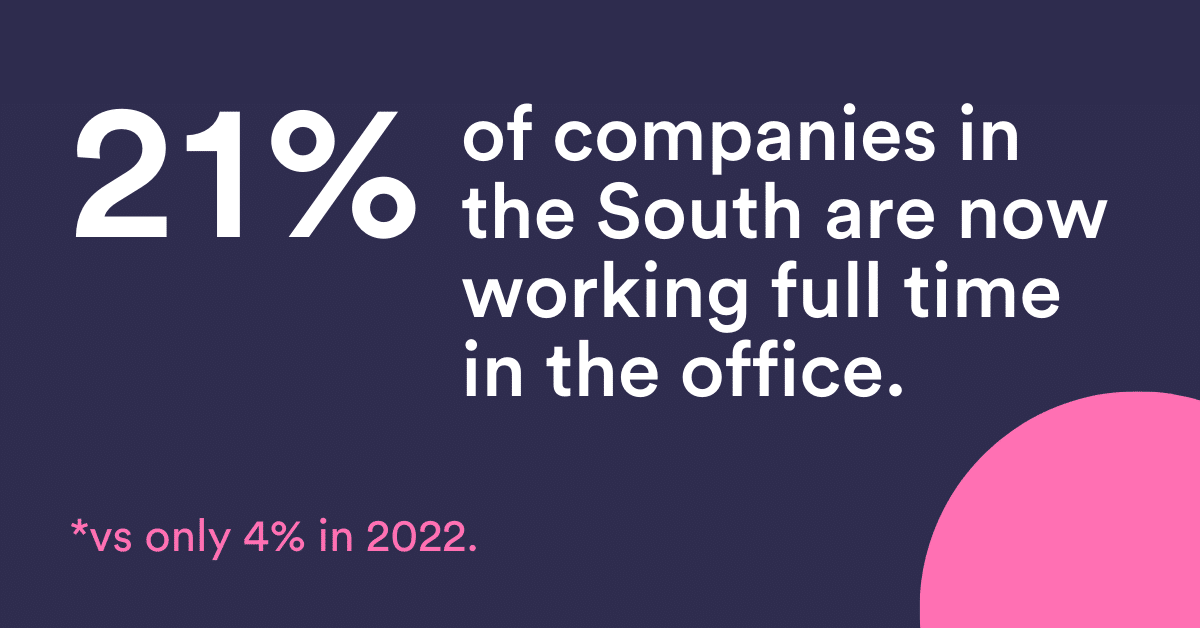

- Companies not offering either hybrid working or working from home has increased greatly with 21% working full-time in the office (compared to only 4% last year).

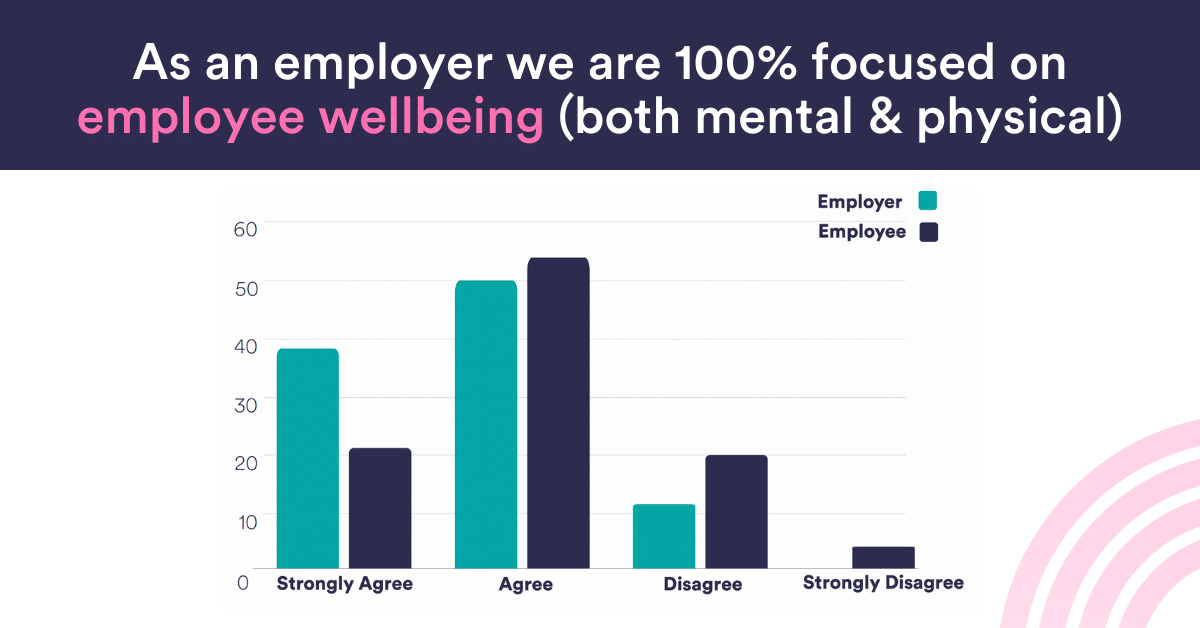

- Disparities exist in the extent that employers and employees perceive business focus on employee wellbeing.

- 78% of employees receive 25+ days of Annual Leave (excluding bank holidays) with only 8% receiving the minimum entitlement of 20 days per annum.

Business confidence

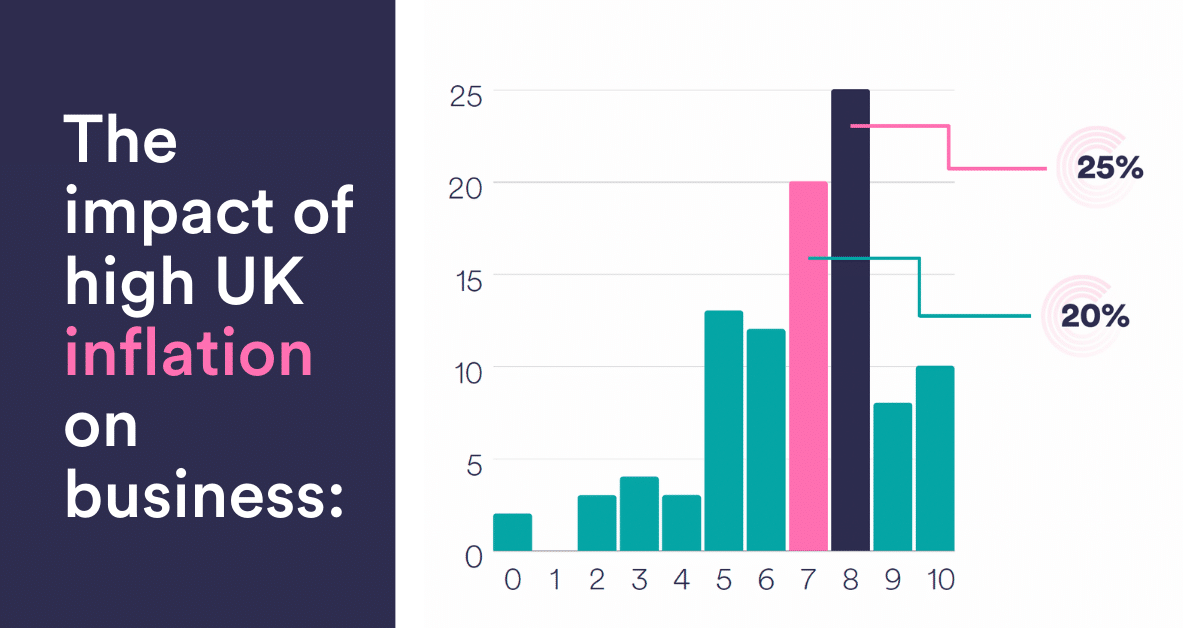

High UK interest rates have caused a significant impact on businesses across the region. Almost a fifth (18%) of businesses rated the impact as 5/10, while 16% rated the impact as 8/10.

When it came to the UK’s high inflation, businesses in the South have felt a very significant impact; 63% of businesses rated it a 7+. This was due to the increase in input costs and wage pressures leading to reduced profit margins.

Business confidence in the short and medium-term remains robust in the region despite the on-going macro-economic challenges. 71% of employers cite confidence levels as 7+. This confidence is due to feelings that inflation levels and interest rates have peaked.

Employee retention

There has been a big shift in the focus on employee retention over the past 12 months, with 65% of companies agreeing on this. This focus shift is due to skills shortage and recruitment challenges. Companies are investing in development and training, and there is a growing awareness of employee wellbeing and factors like work-life balance.

Counter offers

A counter offer is seen as a useful tool to retain organisational knowledge and technical skills. 42% of businesses have made more counter offers in the past 12 months, with factors such as knowing the difficulty of sourcing a replacement and the costs of recruitment and training playing into this.

Meanwhile 23% say they have used fewer counter offers and 30% of respondents say that counter offers are ineffective. This is because counter offers provide only a short-term fix, as the underlying issues still persist. Only 1 in 5 companies have a formal counter offer policy.

Changes to flexible working

Hybrid and flexible working remains a hot topic and we have certainly seen changes in flexible working policies over the past year, with a greater move back to the office. Although 61% of companies have seen no change in their flexible working in the past 12 months, over a quarter (28%) have seen an increase in the time spent in the office.

21% of companies in the South are now working full time in the office, compared with just 4% in 2023.

The main reasons given for this shift were the greater levels of collaboration and communication, as well as the improved retention of company culture.

Career progression & employee wellbeing

Disparities exist in the extent that employers and employees perceive business focus on employee wellbeing. 38% of employers strongly felt they were 100% focused on both the physical and mental health of their team, while just 21% of employees felt the same. 4% of employees strongly disagreed with this statement.

When it comes to career development, there is a further disconnect between the perceptions of employers and employees in this area. 57% of employees are not clear on what is required to progress within the company.

AI in business

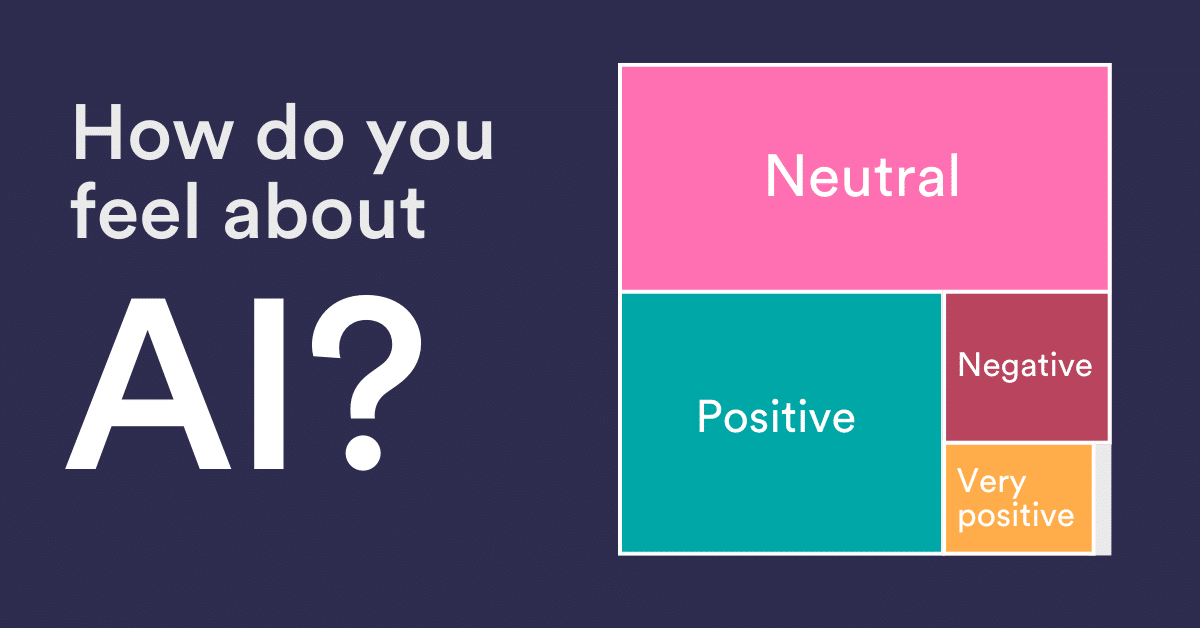

There is a lot of scepticism around AI, predominately due to a lack of understanding, and possibly some job displacement concerns.

When asked if they see AI being a big part of their business in 2024/25, almost half of respondents (44%) said no. Almost a third (32%) said yes, while just under a quarter (24%) aren’t sure.

Only 13% of respondents currently use AI regularly. The majority rarely use it (42%), and almost a third (29%) never use it.

Employer considerations

When reviewing your approach to engaging, retaining and attracting employees, there are six questions employers should consider:

- Pay – this is the number one driving factor, so employers need to consider: Is this competitive?

- Employee value proposition – does this meet your employee’s needs?

- Working patterns – is the balance right for your business?

- Mental health and wellbeing – is a greater focus required here?

- Communication – do you have clear 360-degree communication?

- AI – What are the opportunities for competitive advantage?